The Type Of Cost Accounting System . Cost accounting is an internal process used only by a. It assigns costs to products, services, processes, projects and related activities. A cost accounting system helps determine how much the production of a good or service will cost. Cost accounting is a type of managerial accounting that focuses on the cost structure of a business. There are mainly four types of cost accounting: Cost accounting is a managerial accounting process that involves recording, analyzing, and reporting a company's costs. The types of costs evaluated in cost accounting include variable costs, fixed costs, direct costs, indirect costs, operating costs, opportunity costs, sunk costs, and. There are four major types of cost accounting: Standard cost accounting, activity based accounting, lean accounting and marginal.

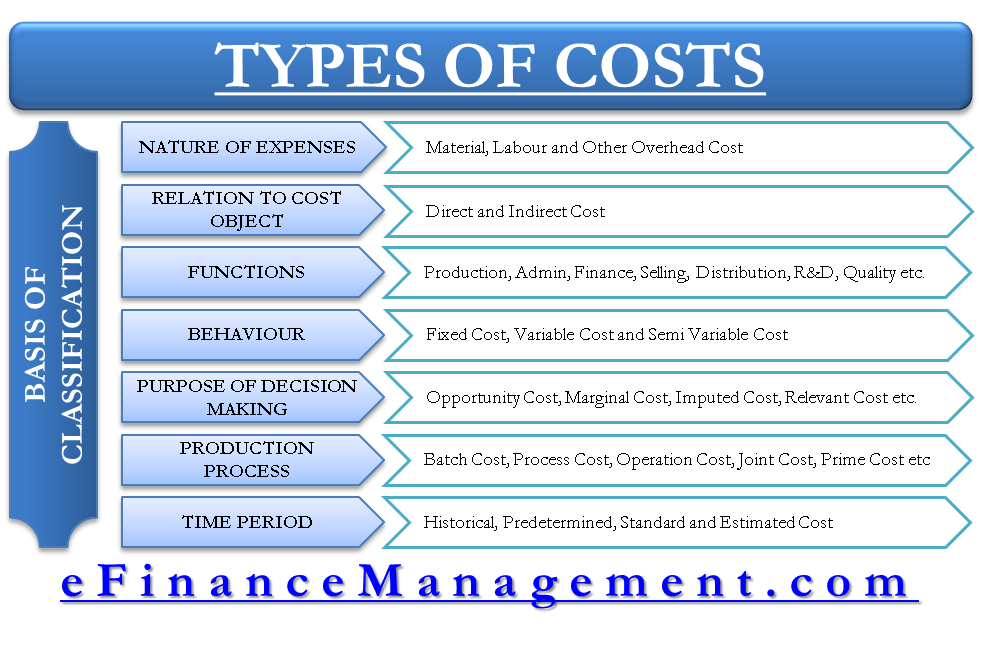

from efinancemanagement.com

Cost accounting is a managerial accounting process that involves recording, analyzing, and reporting a company's costs. It assigns costs to products, services, processes, projects and related activities. There are mainly four types of cost accounting: Cost accounting is an internal process used only by a. The types of costs evaluated in cost accounting include variable costs, fixed costs, direct costs, indirect costs, operating costs, opportunity costs, sunk costs, and. There are four major types of cost accounting: Cost accounting is a type of managerial accounting that focuses on the cost structure of a business. Standard cost accounting, activity based accounting, lean accounting and marginal. A cost accounting system helps determine how much the production of a good or service will cost.

Types and Basis of Cost Classification Nature, Functions, Behavior eFM

The Type Of Cost Accounting System Standard cost accounting, activity based accounting, lean accounting and marginal. It assigns costs to products, services, processes, projects and related activities. Cost accounting is an internal process used only by a. A cost accounting system helps determine how much the production of a good or service will cost. There are mainly four types of cost accounting: Cost accounting is a managerial accounting process that involves recording, analyzing, and reporting a company's costs. Cost accounting is a type of managerial accounting that focuses on the cost structure of a business. The types of costs evaluated in cost accounting include variable costs, fixed costs, direct costs, indirect costs, operating costs, opportunity costs, sunk costs, and. Standard cost accounting, activity based accounting, lean accounting and marginal. There are four major types of cost accounting:

From www.opencostaccounting.org

8 Lean Accounting Open Cost Accounting The Type Of Cost Accounting System Cost accounting is an internal process used only by a. Standard cost accounting, activity based accounting, lean accounting and marginal. It assigns costs to products, services, processes, projects and related activities. Cost accounting is a managerial accounting process that involves recording, analyzing, and reporting a company's costs. Cost accounting is a type of managerial accounting that focuses on the cost. The Type Of Cost Accounting System.

From www.slideserve.com

PPT Principles of Cost Accounting 14E PowerPoint Presentation, free The Type Of Cost Accounting System Cost accounting is a managerial accounting process that involves recording, analyzing, and reporting a company's costs. Cost accounting is a type of managerial accounting that focuses on the cost structure of a business. There are mainly four types of cost accounting: There are four major types of cost accounting: It assigns costs to products, services, processes, projects and related activities.. The Type Of Cost Accounting System.

From www.educba.com

Types of Accounting 7 Different Types of Accounting with Explanation The Type Of Cost Accounting System Cost accounting is a managerial accounting process that involves recording, analyzing, and reporting a company's costs. A cost accounting system helps determine how much the production of a good or service will cost. There are four major types of cost accounting: The types of costs evaluated in cost accounting include variable costs, fixed costs, direct costs, indirect costs, operating costs,. The Type Of Cost Accounting System.

From innovatureinc.com

The 3 Types Of Accounting Systems (cost, Managerial, And Financial The Type Of Cost Accounting System Standard cost accounting, activity based accounting, lean accounting and marginal. Cost accounting is an internal process used only by a. Cost accounting is a managerial accounting process that involves recording, analyzing, and reporting a company's costs. There are mainly four types of cost accounting: Cost accounting is a type of managerial accounting that focuses on the cost structure of a. The Type Of Cost Accounting System.

From www.numerade.com

SOLVED Question 13 There are two basic types of cost accounting The Type Of Cost Accounting System A cost accounting system helps determine how much the production of a good or service will cost. It assigns costs to products, services, processes, projects and related activities. Standard cost accounting, activity based accounting, lean accounting and marginal. There are mainly four types of cost accounting: Cost accounting is a managerial accounting process that involves recording, analyzing, and reporting a. The Type Of Cost Accounting System.

From whitebooks.in

Cost Accounting Definition, Types And Advantages Whitebooks Blog The Type Of Cost Accounting System The types of costs evaluated in cost accounting include variable costs, fixed costs, direct costs, indirect costs, operating costs, opportunity costs, sunk costs, and. Cost accounting is a managerial accounting process that involves recording, analyzing, and reporting a company's costs. A cost accounting system helps determine how much the production of a good or service will cost. Standard cost accounting,. The Type Of Cost Accounting System.

From www.youtube.com

Cost Classification Introduction to Cost & Management Accounting The Type Of Cost Accounting System A cost accounting system helps determine how much the production of a good or service will cost. Cost accounting is a type of managerial accounting that focuses on the cost structure of a business. The types of costs evaluated in cost accounting include variable costs, fixed costs, direct costs, indirect costs, operating costs, opportunity costs, sunk costs, and. There are. The Type Of Cost Accounting System.

From www.slideserve.com

PPT COST ACCOUNTING SYSTEMS PowerPoint Presentation, free download The Type Of Cost Accounting System There are mainly four types of cost accounting: Standard cost accounting, activity based accounting, lean accounting and marginal. Cost accounting is a managerial accounting process that involves recording, analyzing, and reporting a company's costs. Cost accounting is a type of managerial accounting that focuses on the cost structure of a business. The types of costs evaluated in cost accounting include. The Type Of Cost Accounting System.

From razorpay.com

Why Cost Accounting is Important to Businesses? RazorpayX The Type Of Cost Accounting System A cost accounting system helps determine how much the production of a good or service will cost. The types of costs evaluated in cost accounting include variable costs, fixed costs, direct costs, indirect costs, operating costs, opportunity costs, sunk costs, and. There are four major types of cost accounting: Cost accounting is a managerial accounting process that involves recording, analyzing,. The Type Of Cost Accounting System.

From analyticsjobs.in

Cost Accounting Meaning, Types, Advantages And Disadvantages The Type Of Cost Accounting System The types of costs evaluated in cost accounting include variable costs, fixed costs, direct costs, indirect costs, operating costs, opportunity costs, sunk costs, and. A cost accounting system helps determine how much the production of a good or service will cost. There are four major types of cost accounting: Standard cost accounting, activity based accounting, lean accounting and marginal. It. The Type Of Cost Accounting System.

From www.investopedia.com

Cost Accounting Definition and Types With Examples The Type Of Cost Accounting System Cost accounting is an internal process used only by a. There are four major types of cost accounting: A cost accounting system helps determine how much the production of a good or service will cost. The types of costs evaluated in cost accounting include variable costs, fixed costs, direct costs, indirect costs, operating costs, opportunity costs, sunk costs, and. Cost. The Type Of Cost Accounting System.

From accountingsoftworks.com

What are the differences between financial accounting and cost The Type Of Cost Accounting System A cost accounting system helps determine how much the production of a good or service will cost. There are mainly four types of cost accounting: Cost accounting is a managerial accounting process that involves recording, analyzing, and reporting a company's costs. Cost accounting is an internal process used only by a. It assigns costs to products, services, processes, projects and. The Type Of Cost Accounting System.

From present5.com

CHAPTER 13 Cost Accounting and Reporting Systems 1 The Type Of Cost Accounting System Cost accounting is a managerial accounting process that involves recording, analyzing, and reporting a company's costs. Cost accounting is a type of managerial accounting that focuses on the cost structure of a business. There are mainly four types of cost accounting: Cost accounting is an internal process used only by a. A cost accounting system helps determine how much the. The Type Of Cost Accounting System.

From www.iedunote.com

Cost Accounting Definition, Characteristics, Objectives, Cost The Type Of Cost Accounting System A cost accounting system helps determine how much the production of a good or service will cost. Cost accounting is a managerial accounting process that involves recording, analyzing, and reporting a company's costs. Cost accounting is an internal process used only by a. The types of costs evaluated in cost accounting include variable costs, fixed costs, direct costs, indirect costs,. The Type Of Cost Accounting System.

From www.coursehero.com

[Solved] Part (a) Distinguish between the two types of cost The Type Of Cost Accounting System Cost accounting is a managerial accounting process that involves recording, analyzing, and reporting a company's costs. There are mainly four types of cost accounting: Cost accounting is an internal process used only by a. There are four major types of cost accounting: A cost accounting system helps determine how much the production of a good or service will cost. Standard. The Type Of Cost Accounting System.

From gamma.app

Cost Accounting System A Comprehensive Guide The Type Of Cost Accounting System Cost accounting is a managerial accounting process that involves recording, analyzing, and reporting a company's costs. It assigns costs to products, services, processes, projects and related activities. Cost accounting is a type of managerial accounting that focuses on the cost structure of a business. Standard cost accounting, activity based accounting, lean accounting and marginal. A cost accounting system helps determine. The Type Of Cost Accounting System.

From benjaminwann.com

8 Types Of Cost In Cost Accounting The Type Of Cost Accounting System There are mainly four types of cost accounting: Cost accounting is a managerial accounting process that involves recording, analyzing, and reporting a company's costs. Cost accounting is a type of managerial accounting that focuses on the cost structure of a business. There are four major types of cost accounting: The types of costs evaluated in cost accounting include variable costs,. The Type Of Cost Accounting System.

From educationleaves.com

What is Cost Accounting? [PDF Inside] Types, Objectives, Functions The Type Of Cost Accounting System It assigns costs to products, services, processes, projects and related activities. There are four major types of cost accounting: A cost accounting system helps determine how much the production of a good or service will cost. Cost accounting is a type of managerial accounting that focuses on the cost structure of a business. Cost accounting is an internal process used. The Type Of Cost Accounting System.